How Financial Services Can Benefit From Digital Transformation

You’re probably tyred of being left in the dust by fintech disruptors and digital-savvy competitors. Embracing digital transformation can be your ticket to staying ahead of the game. By going digital, you can slash operational costs, boost customer satisfaction, and even increase revenue growth. Imagine streamlining tedious processes, automating repetitive tasks, and making data-driven decisions that drive growth. And, let’s not forget, building resilience against disruptions. If you want to stay competitive in today’s digital age, it’s time to transform – and the benefits are just a click away.

Key Takeaways

• Digital transformation enhances customer experience through omnichannel engagement, personalised interactions, and streamlined onboarding processes.• Automation of repetitive tasks and workflows improves operational efficiency, reduces costs, and redirects resources towards strategic pursuits.• Data-driven decision making enabled by advanced analytics platforms helps financial institutions make informed, predictive, and proactive business decisions.• Digital transformation enables financial institutions to identify and mitigate potential risks, ensuring business continuity and minimising disruptions.• Implementation of robust cybersecurity strategies and contingency plans safeguards against cyberattacks and ensures resilience in the face of disruptions.

Embracing Digital Channels

As you dive headfirst into the world of digital transformation, embracing digital channels becomes the ultimate game-changer, catapulting your business into the 21st century and leaving antiquated methods in the dust.

Think about it – traditional banking hours are so last century. With digital channels, you can cater to the always-on, always-connected customer who demands convenience and flexibility. Digital onboarding, for instance, streamlines the onboarding process, reducing tedious paperwork and lengthy wait times. It’s a no-brainer, really. By going digital, you’re not only improving the customer experience but also reducing operational costs.

And let’s not forget social media – the ultimate digital playground. You can engage with customers, share valuable content, and even provide customer support through social media channels. It’s a two-way conversation, folks! You get to listen to customer feedback, respond to concerns, and build a community around your brand. The result? Increased brand loyalty, improved customer satisfaction, and a healthy dose of word-of-mouth marketing.

Enhancing Customer Experiences

You’ve won the battle of convenience with digital channels, but now it’s time to take customer experiences to the next level by creating personalised, intuitive, and seamless interactions that make customers wonder how they ever lived without your brand.

Think about it – customers have endless options, and if you don’t impress, they’ll switch to a competitor faster than you can say ‘fintech disruption‘.

To avoid being left in the dust, you need to craft omnichannel engagement that’s nothing short of magical.

That means ensuring that every touchpoint, from mobile apps to ATMs, speaks to customers in a language that’s uniquely theirs.

Personalised interactions aren’t just a nice-to-have; they’re a must-have.

When customers feel seen and heard, they become loyal advocates who’ll shout your brand’s praises from the rooftops.

Streamlining Operations Efficiently

You’re probably tyred of wasting time and resources on manual processes that are as outdated as your aunt’s Facebook profile picture.

It’s time to bring your operations into the 21st century with process automation tools that’ll make your workflows more efficient than a Swiss clock.

Process Automation Tools

Streamlining operations efficiently means ditching tedious manual tasks, and process automation tools are the superheroes that save the day by taking over repetitive and mundane chores, freeing you up to tackle the good stuff.

With automation, you can focus on high-leverage activities that drive growth and innovation, rather than getting bogged down in paperwork and data entry.

Task prioritisation becomes a breeze when you can automate routine tasks, allowing you to focus on high-impact activities that drive revenue and growth.

Compliance management also becomes more manageable, as automated workflows guaranty that regulatory requirements are met, reducing the risk of non-compliance.

Efficient Workflows Design

By designing efficient workflows, you’ll slash the time and energy wasted on redundant tasks, freeing up resources to tackle the heavy lifting that drives real results.

It’s time to ditch the ‘that’s how we’ve always done it’ mentality and optimise your operations for the digital age. Efficient workflows are all about streamlining tasks, eliminating bottlenecks, and automating the mundane.

With task prioritisation, you’ll focus on high-impact activities that drive revenue growth, rather than getting bogged down in administrative tasks.

System integration is key to seamless workflows.

By connecting disparate systems, you’ll eliminate data silos, reduce errors, and increase productivity. No more manual data entry or tedious reconciliations – your team can focus on higher-value tasks that drive business growth.

With efficient workflows, you’ll reduce operational costs, improve customer satisfaction, and gain a competitive edge in the market.

Reducing Costs Through Automation

As you set out on your digital transformation journey, you’ll likely find that automating repetitive tasks is a surefire way to slash operational costs and redirect those savings towards more strategic pursuits. By streamlining processes, you’ll uncover opportunities to simplify, standardise, and automate tasks that are currently eating away at your bottom line. Process simplification is key here – by eliminating unnecessary steps and condensing workflows, you’ll reduce the likelihood of human error and free up resources to focus on higher-value tasks.

| Task | Pre-Automation | Post-Automation |

|---|---|---|

| Data Entry | 5 hours/week | 30 minutes/week |

| Report Generation | 2 hours/day | 15 minutes/day |

| Compliance Cheques | 10 hours/month | 1 hour/month |

Improving Data-Driven Decision Making

You’ve finally decided to leave gut feelings behind and make data-driven decisions.

Now, it’s time to supercharge your decision-making process with cutting-edge tools.

Think data analytics platforms that churn out actionable insights, real-time reporting that keeps you on your toes, and predictive modelling tools that let you peek into the future.

Data Analytics Platforms

Tyred of flying blind in your business, relying on gut feelings rather than hard data to inform your decisions?

It’s time to harness the power of data analytics platforms to drive your financial services organisation forward.

A solid data analytics platform is the backbone of data-driven decision making, providing a single source of truth for your organisation.

By implementing a platform that prioritises Data Governance, you can certify data quality, integrity, and security, giving you the confidence to make informed decisions.

Advanced Visualisation capabilities take your data analysis to the next level, allowing you to uncover hidden patterns, trends, and insights that would be impossible to discern from raw data alone.

With a robust data analytics platform, you’ll be able to slice and dice your data, identifying areas of opportunity and optimising business outcomes.

Say goodby to flying blind and hello to data-driven decision making.

It’s time to take control of your business and let the numbers do the talking.

Real-Time Insights Generation

Every minute counts in the fast-paced world of financial services, and waiting for batch-processed reports just won’t cut it – you need real-time insights to stay ahead of the curve.

You can’t afford to make decisions based on yesterday’s data; you need to know what’s happening now. That’s where real-time insights generation comes in.

With the help of machine learning and data visualisation, you can turn your data into actionable insights in real-time. No more waiting for reports to be generated, no more manual data analysis – just instant access to the information you need to make informed decisions.

Imagine being able to identify trends and patterns as they emerge, and respond quickly to changes in the market.

With real-time insights, you can do just that. You’ll be able to spot opportunities and risks as they arise, and make data-driven decisions that drive growth and profitability.

And with data visualisation, you’ll be able to communicate complex insights to stakeholders in a clear and concise way.

It’s time to leave batch processing in the dust and step into the world of real-time insights generation – your business depends on it.

Predictive Modelling Tools

By the time you’ve got your real-time insights in place, it’s time to take your data-driven decision making to the next level with predictive modelling tools that can turn those insights into actionable forecasts.

Think of it as upgrading from a rear-view mirror to a crystal ball – you’re no longer just looking at what’s happened, you’re predicting what’s likely to happen next.

With predictive modelling tools, you can run complex simulations, identify potential risks, and optimise your portfolio for maximum returns.

It’s like having a superpower that lets you peer into the future and make informed decisions.

For instance, you can use risk analysis to identify potential pitfalls and adjust your strategy accordingly.

Or, you can use portfolio optimisation to maximise returns while minimising risk.

The possibilities are endless, and the benefits are significant.

By leveraging predictive modelling tools, you’ll be able to make more accurate predictions, reduce uncertainty, and drive business growth.

Take the leap and discover the power of predictive modelling for yourself.

Building Resilience Against Disruption

As you’re traversing the digital landscape, you’re constantly dodging disruptions that can cripple your business, from cyberattacks to supply chain failures. It’s like traversing a minefield, where one wrong step can lead to catastrophic consequences.

Building resilience against disruption is no longer a nice-to-have, but a must-have for financial services companies.

Risk management is key to mitigating these disruptions. You need to identify potential risks, assess their impact, and develop strategies to minimise them.

This includes having robust cybersecurity strategies in place to prevent cyberattacks, which can compromise sensitive customer data and damage your reputation.

It’s not just about reacting to disruptions; it’s about being proactive.

You need to anticipate potential disruptions and develop contingency plans to maintain business continuity.

This includes having backup systems, diversifying your supply chain, and having a crisis management plan in place to safeguard against disruptions.

Conclusion

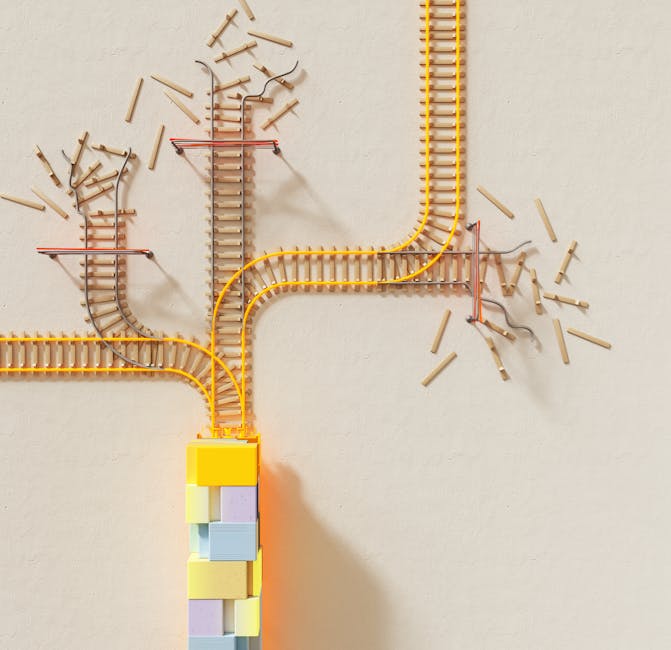

As you stand at the crossroads of traditional banking and digital innovation, the path forward is clear.

Embracing digital transformation is no longer a choice, but a necessity.

Imagine a future where transactions are seamless, customer experiences are tailored, and data-driven insights fuel growth.

The landscape of financial services is shifting, and you’re holding the map.

Will you lead the charge or get left in the dust?

Contact us to discuss our services now!